Earnings Limit For Social Security 2025

Earnings Limit For Social Security 2025. 50% of anything you earn over the cap. Above that limit, beneficiaries lose $1 in benefits for.

For retirees, the average increase is about $59 per. The 2025 annual limit ($22,320), they will receive a social security payment for november and december.

Social Security Payment Of $4,873 To Go Out This Week.

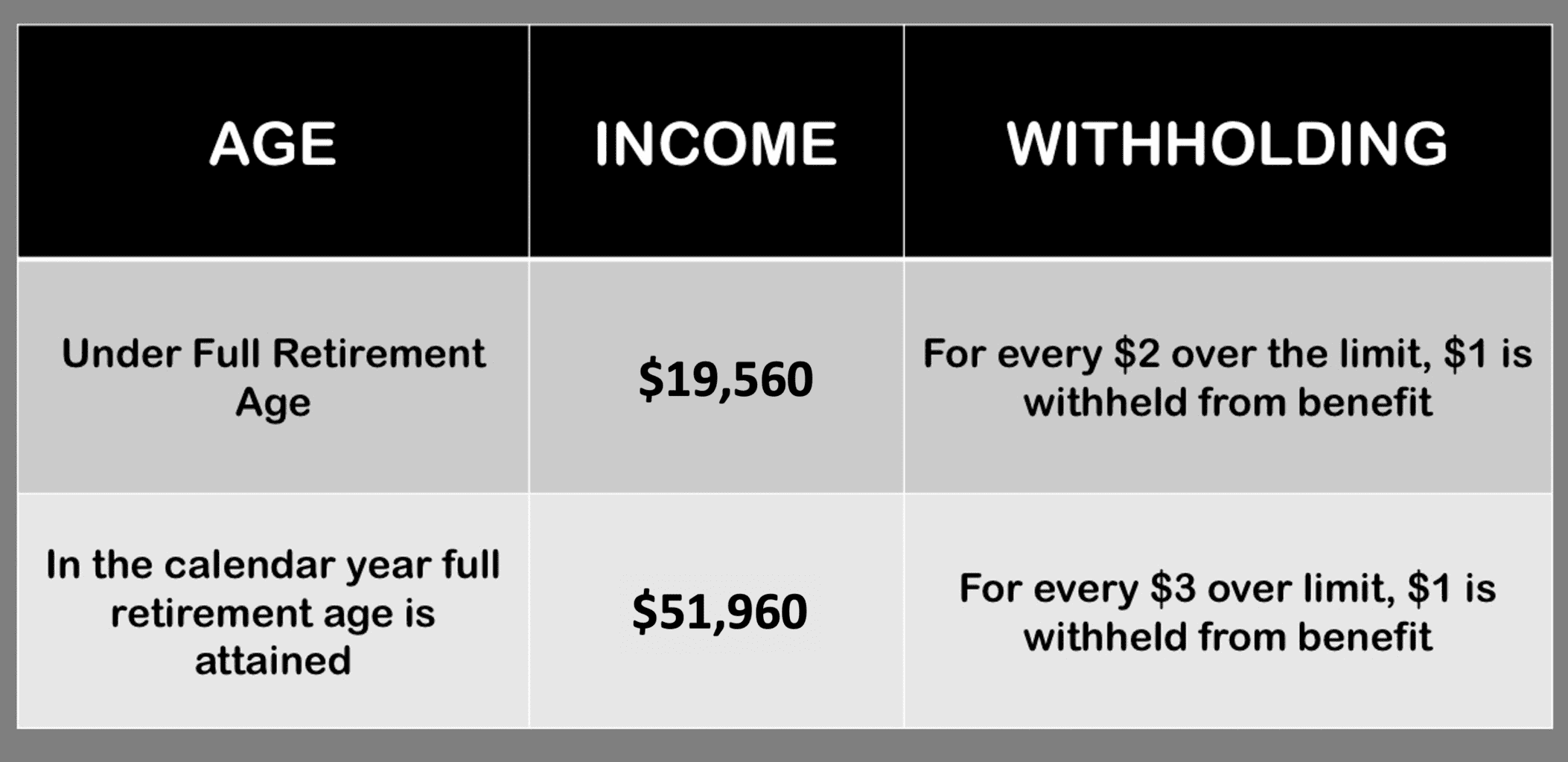

For every $2 over the limit, $1 is withheld from benefits.

Starting With The Month You Reach Full Retirement Age, You.

This is because their earnings in those months are $1,860 or less than.

• 3Mo • 2 Min Read.

Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit. Starting with the month you reach full retirement age, you.

Source: anna-dianewjessi.pages.dev

Source: anna-dianewjessi.pages.dev

Ss Earning Limit 2025 Beryle Leonore, The earnings limits for beneficiaries under full retirement age will increase. 50% of anything you earn over the cap.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

2022 social security earnings limit Social Security Intelligence, In 2025, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every. Starting with the month you reach full retirement age, you.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Paying Social Security Taxes on Earnings After Full Retirement Age, Anyone born between the 21st and 31st of any month will have their benefits paid on april 24. Here's a look at the most you can.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

Social Security Limit for 2022 Social Security Genius, The first $168,600 of your wages is subject to the 6.2% old age, survivors and. The maximum benefit amount, however, is more than double that.

Source: www.mercer.com

Source: www.mercer.com

2023 Social Security, PBGC amounts and projected covered compensation, Keep these updated figures in mind if. Social security allows recipients to earn income from a job and also collect benefits at the same time.

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2025, The maximum benefit amount, however, is more than double that. Social security payment of $4,873 to go out this week.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

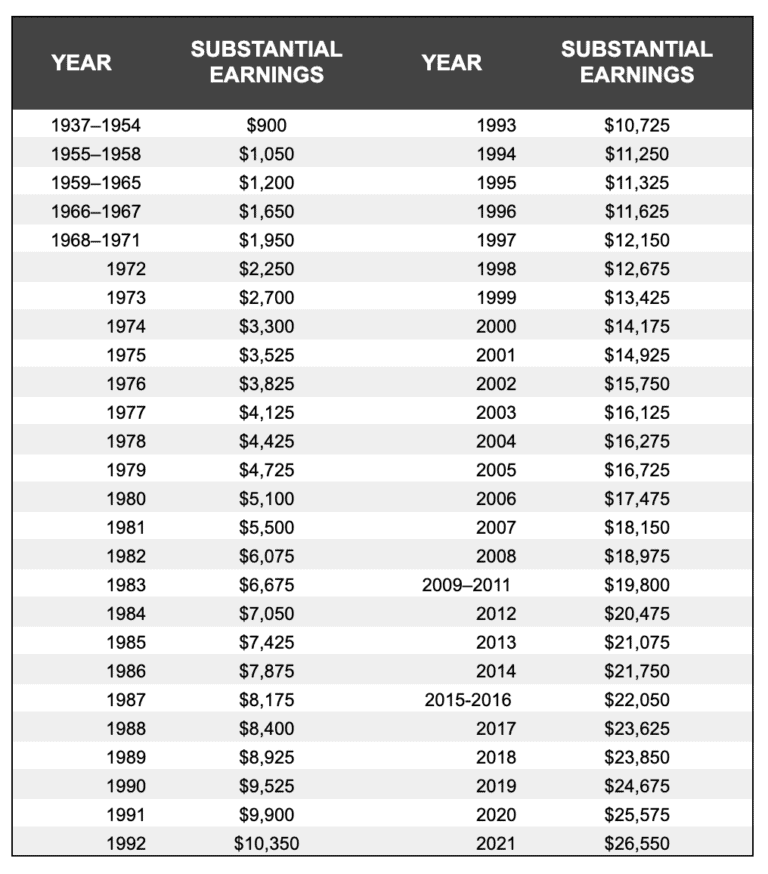

Substantial Earnings for Social Security’s Windfall Elimination, But beyond that point, you'll have $1 in benefits withheld per $2 of earnings. In 2025, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

Substantial Earnings for Social Security’s Windfall Elimination, For every $2 over the limit, $1 is withheld from benefits. Here's a look at the most you can.

Source: cwccareers.in

Source: cwccareers.in

Social Security Tax Limit 2025 Know Taxable Earnings, Increase, Starting with the month you reach full retirement age, you. In 2025, you can earn up to $22,320 without having your social security benefits withheld.

Be Under Full Retirement Age For All Of 2025, You Are Considered Retired In Any Month That Your Earnings Are $1,860 Or Less And You Did Not Perform Substantial Services In Self.

In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit.

Above That Limit, Beneficiaries Lose $1 In Benefits For.

Workers become eligible for retirement benefits at age 62 even if they are still.